Business Insurance in and around Wylie

Get your Wylie business covered, right here!

Helping insure small businesses since 1935

Help Protect Your Business With State Farm.

Though it's not fun to think about, it is good to recognize that some things are simply out of your control. Catastrophes happen, like a customer stumbles and falls on your property.

Get your Wylie business covered, right here!

Helping insure small businesses since 1935

Protect Your Future With State Farm

With State Farm small business insurance, you can give yourself more protection! State Farm agent Adam Leggett is ready to help you handle the unexpected with reliable coverage for all your business insurance needs. Such individual service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If you have problems at your business, Adam Leggett can help you file your claim. Keep your business protected and growing strong with State Farm!

Do what's right for your business, your employees, and your customers by getting in touch with State Farm agent Adam Leggett today to discover your business insurance options!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

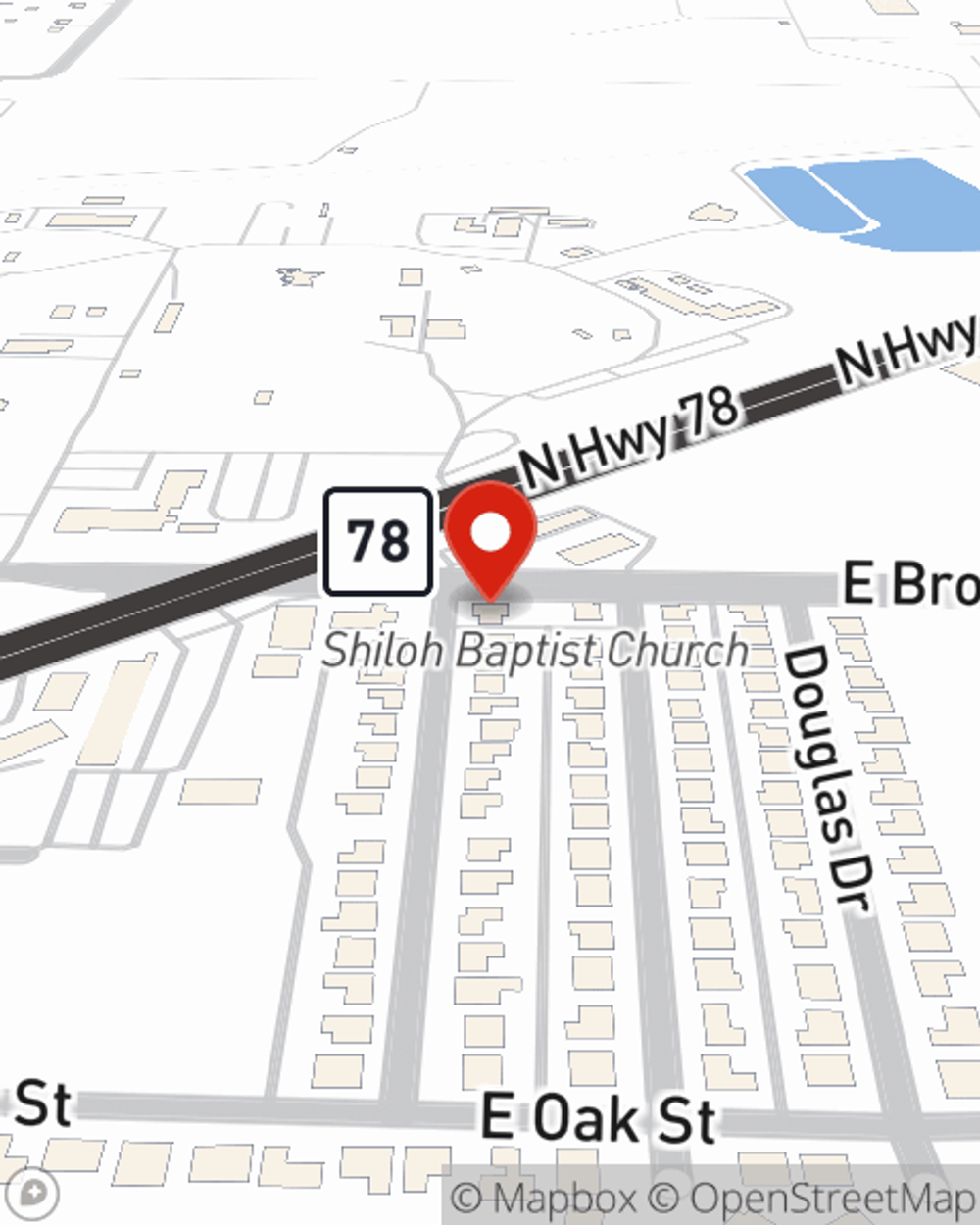

Adam Leggett

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".